Getting The Home Equity Loan copyright To Work

Table of ContentsThe Only Guide to Home Equity Loan copyrightEverything about Home Equity Loan copyrightEverything about Home Equity Loan copyrightThe Home Equity Loan copyright Ideas

Fixed-rate home equity lendings give one swelling amount, whereas HELOCs supply debtors rotating lines of credit scores. Investopedia/ Zoe Hansen Basically, a home equity loan is comparable to a mortgage, for this reason the name 2nd home mortgage.Standard home equity finances have an established repayment term, just like conventional home mortgages. The customer makes routine, fixed settlements covering both major and interest. Similar to any kind of mortgage, if the lending is not settled, the home can be marketed to satisfy the staying debt. A home equity financing can be an excellent way to transform the equity you've developed in your home into cash money, particularly if you spend that money in home improvements that raise the worth of your home (Home Equity Loan copyright). Should you wish to move, you might wind up shedding money on the sale of the home or be unable to move. And if you're obtaining the financing to pay off credit score card debt, stand up to the lure to run up those charge card expenses once more. Prior to doing something that puts your house at risk, evaluate all of your choices.

Even though home equity car loans have lower interest rates, your term on the brand-new finance might be longer than that of your existing debts.

The smart Trick of Home Equity Loan copyright That Nobody is Talking About

The repayment and interest rate remain the exact same over the life time of the financing. The car loan needs to be paid off in complete if the home on which it is based is sold.

If you have a steady, trustworthy resource of revenue and understand that you will certainly be able to settle the car loan, then low-interest rates and feasible tax deductions make home equity lendings a practical selection. Obtaining a home equity lending is quite basic for lots of consumers because it is a protected financial obligation.

The interest rate on a home equity loanalthough more than that of an initial mortgageis much lower than that of charge card and check over here other customer financings. That aids describe why a primary factor that customers borrow against the worth of their homes by means of a fixed-rate home equity funding is to settle credit history card balances.

The 10-Second Trick For Home Equity Loan copyright

Understand that the passion paid on the portion of the financing that is above the value of the home is never check my source ever tax deductible (Home Equity Loan copyright). When looking for a home equity lending, there can be some lure to obtain greater than you quickly need due to the fact that you only obtain the payment when and do not know if you'll qualify for another finance in the future

State you have an auto funding with an equilibrium of $10,000 at a rates of interest of 9% with 2 years continuing to be on the term. Settling that debt to a home equity finance at a price of 4% with a regard to five years would actually cost you more money if you took all five years to pay off the home equity funding.

Failing can result in its loss, and losing your home best site would be substantially a lot more catastrophic than surrendering an automobile. A home equity financing is a car loan for a set amount of money, paid off over a set time period that utilizes the equity you have in your home as collateral for the finance.

The Facts About Home Equity Loan copyright Revealed

, making a list of to deduct the interest paid on a home equity car loan might not lead to financial savings for most filers.

This suggests that the total amount of the balances on the home loan, any type of existing HELOCs, any kind of existing home equity finances, and the brand-new home equity loan can not be even more than 90% of the appraised worth of the home. As an example, a person with a home that evaluated for $500,000 with an existing mortgage balance of $200,000 could obtain a home equity lending for up to $250,000 if they are authorized.

Home equity is the part of your home that you have. You might require to get a home evaluation to identify the worth of your home. Home equity is the difference in between your home's evaluated value and just how much you owe on: your home mortgage your home equity credit line (HELOC) other fundings and lines of credit scores protected by your home As an example, suppose your home is worth $250,000, and your mortgage equilibrium is $150,000.

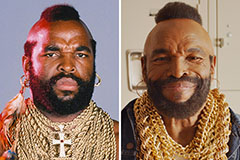

Mr. T Then & Now!

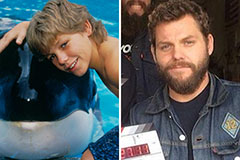

Mr. T Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!